For example, if the value of long-term debt in relation to the total assets value is high, it may signal that the company may become distressed. The amount of capital contributed by the shareholders is represented by the Equity and is also called shareholder’s equity. This ratio calculates the number of times the company collects the average accounts receivable over a given period. Such a report format can be efficiently used for demonstrating the company’s financial position at a glance during corporate meetings, presentations, and reports.

Vertical Analysis: Overview, Formula, Components, How to Conduct, Benefits & Limitations

- By analyzing these ratios using vertical analysis, you can gain insights into a company’s cash flow management and capital allocation strategies.

- Incorporating vertical analysis into your financial decision-making process allows for deeper understanding and informed choices.

- For example, Apple’s gross margin in 2018 was 38.34%, slightly down from 39.08% in 2016.

- In vertical analysis of the cash flow statement, each line item is expressed as a percentage of total sales.

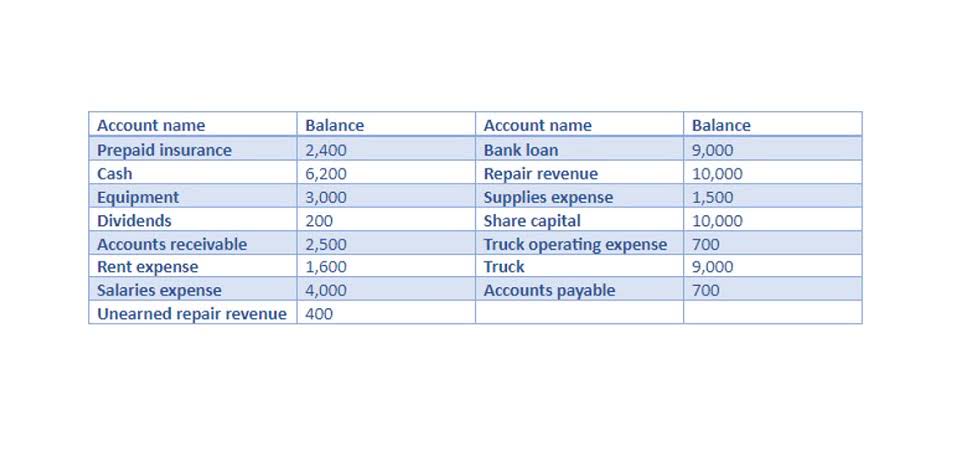

- The business is in fair financial health and is majorly funded by the owner’s capital.

- Financial statements that include vertical analysis clearly show line item percentages in a separate column.

One of the advantages of common-size analysis is that it can be used for inter-company comparison of enterprises with different sizes because all items are expressed as a percentage of some common number. This process helps to analyze the impact of each item in the income statement on the company’s profitability at different levels, including gross margin, operating income margin, and more. A company’s vertical structure can give investors and analysts insight into its profitability, liquidity, efficiency, and risk profile, allowing them to make informed decisions about investing or lending. The vertical analysis calculator calculates the percentage each income statement line item has to the revenue line. Many investors consider the cash flow statement the most important indicator of a company’s performance.

Application in the Income Statement

The balance sheet provides a snapshot of a company’s financial position at a specific point in time. The balance sheet helps evaluate the company’s liquidity, solvency, and overall financial health. For cash flow example, if total sales are $500,000 and gross profit is $200,000, the gross profit margin is ($200,000 ÷ $500,000) × 100, or 40%.

Business is Our Business

In addition, evaluating key financial ratios such as profitability, liquidity, and solvency helps finance teams and business leaders assess resource management and progress toward financial goals. Investors also use ratio analysis to gauge a company’s financial health and growth potential for informed investment decisions. On the other hand, horizontal analysis refers to the analysis of specific line items and comparing them to a similar line item in the previous or subsequent financial period. Although common size analysis is not as detailed as trend analysis using ratios, it does provide a simple way for financial managers to analyze financial statements. It is to protect the company’s performance in an investors’ meet where it is seeking a successful funding round. The business is in fair financial health and is majorly funded by the owner’s capital.

Vertical analysis is typically used for a single accounting period, whether that’s monthly, quarterly, or annually, and can be particularly helpful when used to compare data for several accounting periods. Vertical analysis is most commonly used within a financial statement for a single reporting period, e.g., quarterly. It is done so that accountants can ascertain the relative proportions of the balances of each account.

- As noted before, we can see that salaries increased to 22% as a percentage of total sales in Year 3, compared to 20% in year 2.

- The main benefit of vertical analysis is that it helps businesses determine whether certain items consistently increase or decrease over time.

- With our financial data presented in Excel, we can start to calculate the contribution percentages on either the side or below the income statement.

- Using the above financial ratios, we can determine how efficiently a company is generating revenue and how quickly it’s selling inventory.

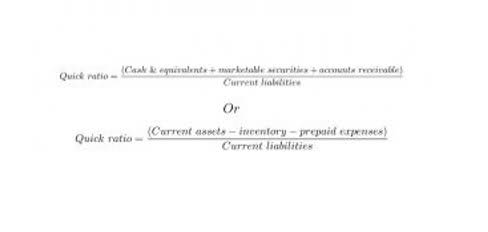

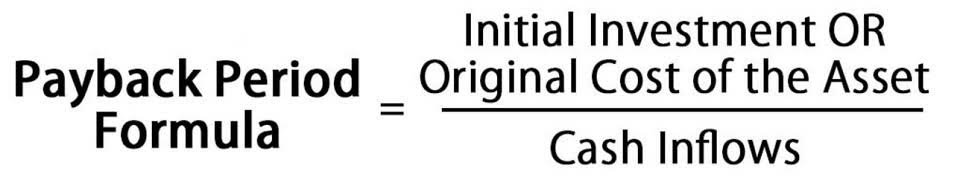

- The balance sheet metrics can be divided into several categories, including liquidity, leverage, and operational efficiency.

- Looking to streamline your business financial modeling process with a prebuilt customizable template?

Integrated Income Statement Analysis

Common-size financial statements often incorporate comparative financial statements that include columns comparing each line item to a previously reported period. The frequency of conducting vertical analysis depends on the company’s reporting requirements and the need for vertical analysis financial analysis. It can be done quarterly, annually, or whenever there is a need to evaluate financial performance. Net sales typically serve as the base amount when conducting vertical analysis on an income statement. This method remains a fundamental tool for understanding and communicating the financial health of a business, providing actionable insights for ongoing financial planning.

For instance, suppose the total assets of a company are Rs.100 crore and cash is Rs.10 crore, then the cash would be 10% of total assets. For the income statement, the base figure used in vertical analysis is typically total net sales or total revenue. Expressing each income statement line item as a percentage of total revenue shows the relative Car Dealership Accounting proportion of revenue that is absorbed by each expense or cost.